2021 Rent Collections | September Quarter

Quarter Day

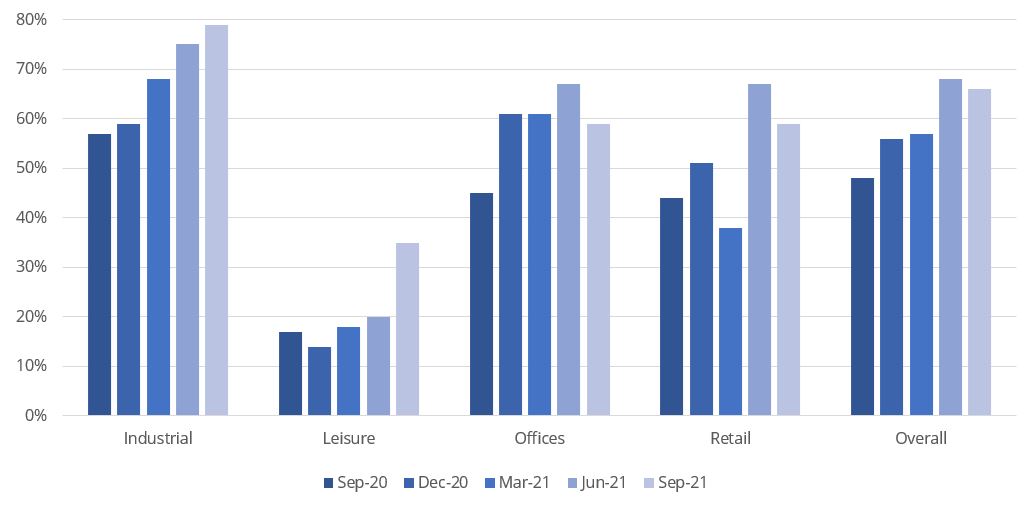

Rent Collection by Sector

Quarter

Update

Much has happened in the two and a half months on from ‘Freedom Day’. With most of the country rolling up their sleeves to get their jab and Boris stuck to his promise to let Brits to start enjoying a life of freedom once again.

On the first day of the new quarter, the most significant jump in rent collection data is in the Leisure sector with Cafes at 38% up from 15% in June and restaurants up from 25% to 47%. Gyms are clearly back open again and trading well posting rent collection at 25% up from 9% last quarter. This is great news when you consider many landlords have allowed tenants to pay monthly – at least for the short term…

Retail has continued to perform well with Shopping Centres and Out of Town posting the highest figures since before the pandemic. High Street is not so positive having fallen from 77% last quarter to 55% - possibly an indication trade has fallen back after the initial peak post lockdown although let’s face it the weather can’t have helped!

Offices saw a slight dip on last quarter, although we see this as merely a blip which should correct itself in the next few weeks.

After a short lived summer of fun, commuters are experiencing jam packed tubes, trains and full platforms as it's back to the office for many, with our ‘normal lives’ returning once again. Whilst we are still some way off pre-pandemic levels, the return to normality is certainly escalating.

Mark Jarrett

Head of Investment Property Management

Quarter Commentary

Sector Spotlight

Retail

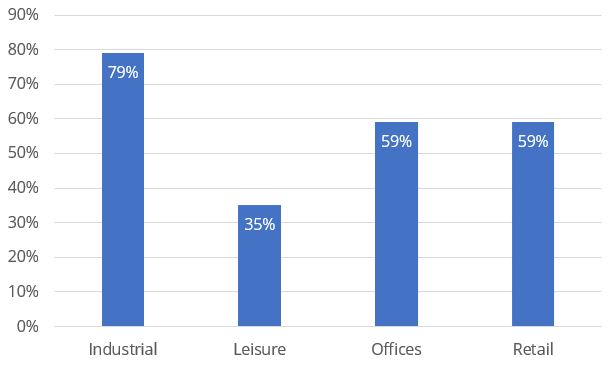

"Retail has seen one of the greatest recoveries in rents collected throughout the pandemic, however this quarter day was slightly down on the last with 59% of rents collected.

With the demand for grocery-backed assets rising to £1.83 billion in 2020 and that trend continuing into 2021, we expect strong rent collections to continue in retail’s most resilient sub-sector.

For the once deemed 'traditional' high street and department stores, the future looks more interesting. As highlighted in Colliers Midsummer Retail Report, whilst online retailing’s functional experience can deliver almost anything to our doors, it can’t give us that immersive social interaction we have craved over the past 18 months. We are now seeing operators show increased appetite for larger floorplates to launch more experiential concepts including the former Paperchase store on Tottenham Court Road to soon be home to a ‘life-size’ version of the famous board game, Monopoly and Gravity taking the Debenhams in Southside."

David Fox, Co-Head of Retail Agency

Leisure

"Over two months on from 'Freedom Day', it is clear that the cabin fever of lockdown drove consumers back out to their favourite restaurants, pubs and gyms throughout July and August and this hasn’t slowed since. It is positive to see the leisure industry thriving again following what has been their toughest year yet. Rent collection has started to gain momentum, with 35% collection, up from just 20% on the June quarter day and we hope to see this continue as occupiers benefit from this exceptionally busy summer period."

Ross Kirton, Head of UK Leisure Agency

Offices

"Since the bank holiday weekend, London’s public transport is busier than ever and we saw a record high of 87% office occupancy from the pre-pandemic levels on the 6 September (Metrikus). In the West End, Q3 take-up (1.2m sq ft) is set to be highest since Q1 2019, 35% above the quarterly average over the past 24 months. With this backdrop, we are unsurprised that the quarter day rent collection for both London and national offices has been extremely positive with 59% of rents collected, however slightly off the June quarter where 67% of rents were collected. We are witnessing momentum continuing to build and it is clear that the Capital is very much back open for business.

Whilst there are still some concerns over the occupiers who continue to review their space requirements, there are a number of others who are committing to London including Facebook who are expanding by 310,000sqft in Euston and Snapchat who are set to grow by 85,000 sq ft in Farringdon, demonstrating considerably improving sentiment.”

Tom Wildash – Co-Head of West End Leasing

Industrial & Logistics

"Industrial, across all subsectors, has once again retained its top spot on rent collections, with 79% collected on the September quarter date and we have no doubt the sector will see close to 100% collected within the coming weeks. With rent collections edging closer to their pre-pandemic levels, it is understandable why the appetite for Industrial and Logistics is insatiable as ever."

Len Rosso, Head of Industrial & Logistics

Rent & Service Charge

Collection

Rent Collection

Service Charge Collection

Confidence is continuing to grow with rent collections sitting at 66% on quarter day. Although results have dipped ever so slightly on the June quarter, one of the hardest hit sectors leisure, has had a significant bounce back with gyms, restaurants and cafes experiencing their best performance in over 18 months.

Across our key property sectors, industrial continues to prove resilient with 79% of rents collected, whilst offices and retail showed a minor decrease with both sectors collecting 59% for the quarter.

With many office based workers slowly getting into the rhythm of hybrid working and retail missing out on foreign summer spending, we are still optimistic that figures will continue to rise over the quarter.

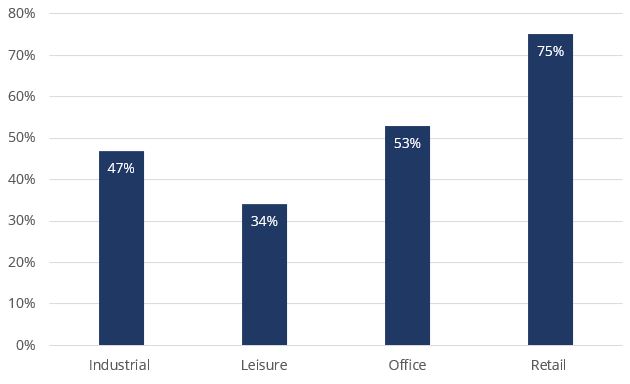

On the September quarter day we have reported the highest service charge collection since the beginning of the pandemic at 59%.

This is up by 10% on the June quarter day and is being led by Retail with 75% of service charge paid and had the biggest change on the previous period.

Heart of the Northland

Sollicitudin tempor id eu nisl nunc mi. Imperdiet dui accumsan sit amet nulla facilisi morbi. Vulputate eu scelerisque felis imperdiet proin fermentum leo. Congue eu consequat ac felis donec et. Vitae aliquet nec ullamcorper sit amet. Nec nam aliquam sem et tortor consequat id porta. At consectetur lorem donec massa sapien. Urna cursus eget nunc scelerisque. Quisque egestas diam in arcu cursus euismod quis.

Heart of Kent Valley

Sollicitudin tempor id eu nisl nunc mi. Imperdiet dui accumsan sit amet nulla facilisi morbi. Vulputate eu scelerisque felis imperdiet proin fermentum leo. Congue eu consequat ac felis donec et. Vitae aliquet nec ullamcorper sit amet. Nec nam aliquam sem et tortor consequat id porta. At consectetur lorem donec massa sapien. Urna cursus eget nunc scelerisque. Quisque egestas diam in arcu cursus euismod quis.

For more information, or to discuss please contact:

Mark Jarrett

Head of Investment Property Management

Visit: www.colliers.com/en-gb/services/investment-property-management

E: mark.jarrett@colliers.com

T: +44 20 7487 1727

Cookie Preferences | Email Subscriptions | Updated: Privacy | Legal | © Copyright 2019.